When calculating the net present value, a situation might arise where you are face with a constant series of payments without an end. This is what we refer to as NPV for a perpetuity.

To find the net present value of a perpetuity, we need to first know the future value of the investment.

General syntax of the formula

NPV(perpetuity)= FV/i

Where;

- FV- is the future value

- i – is the interest rate for the perpetuity

Example

To understand how the NPV of a perpetuity works in excel, we need to consider the example below;

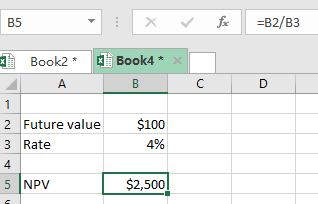

Figure 1: Finding NPV of perpetuity in excel

Figure 1: Finding NPV of perpetuity in excel

To better understand the above NPV, we need to consider a real case study;

Imagine you are evaluating a firm based on its future profits. The firm’s expected profit per year is $100 as shown in cell B2, without an end. The cash flow is then discounted at the rate of 4% as shown in cell B3. To get the NPV, we simply divide the Future value, which is $100, by the rate.

=$100/0.04

=$2,500

What if the cash flow grows at a constant rate?

In a perpetuity case, a scenario might emerge where the cash flow increases at a given constant rate. To find the NPV in such a case, we proceed as follows;

NPV= FV/(i-g)

Where;

- FV– is the future value of the cash flows

- i – is the discount rate

- g- is the growth rate of the firm

Example

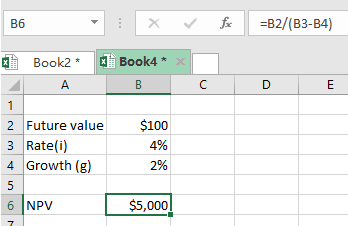

Assume that a firm anticipates a profit of $100 per year without an end. The discounted rate is 4% and the profit is expected to grow at a rate of 2% every year. What is the NPV of the perpetuity?

Answer

NPV(perpetuity)= $100/(0.04-0.02)

Figure 2: NPV of perpetuity with growth rate

Figure 2: NPV of perpetuity with growth rate

Notice that when we have the growth rate given, the NPV is higher than that of when we don’t have a growth rate.

Most of the time, the problem you will need to solve will be more complex than a simple application of a formula or function. If you want to save hours of research and frustration, try our live Excelchat service! Our Excel Experts are available 24/7 to answer any Excel question you may have. We guarantee a connection within 30 seconds and a customized solution within 20 minutes.

Leave a Comment