Figure 1. of Excel ISNA Function.

Figure 1. of Excel ISNA Function.

The purpose of the Excel ISNA Function is to return a TRUE value whenever a cell in our worksheet has a #N/A error as well as return a FALSE value for any other type of error. This step by step tutorial will walk through how to use the ISNA function to test for error

Generic Formula

=ISNA (value)

We can utilize the ISNA Function along with the IF operation syntax to check for any errors as well as to return a specific data value or message when one is found.

How to use the Excel ISNA Function.

We can achieve this by following three simple steps!

- Let’s say we have a set of food items from a store that we are required to test/check for the #N/A error. We must first arrange our available data values within our worksheet. See example illustrated below;

Figure 2. of Items to Check for #N/A Error in Excel.

Figure 2. of Items to Check for #N/A Error in Excel.

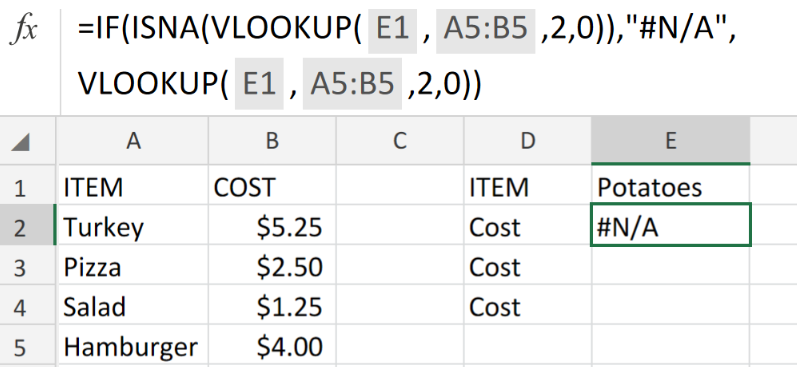

- Our objective is to utilize the Excel ISNA and IF operation syntax to run a check for #N/A Errors. The formula Syntax that we are going to enter into the formula bar for cell E2 of our worksheet is as follows;

=IF(ISNA(VLOOKUP(E1,A5:B5,2,0)),"#N/A",VLOOKUP(E1,A5:B5,2,0))

Figure 3. of ISNA Function in Excel.

Figure 3. of ISNA Function in Excel.

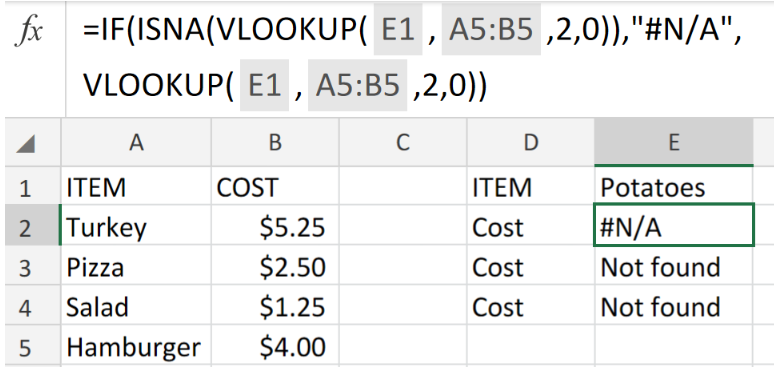

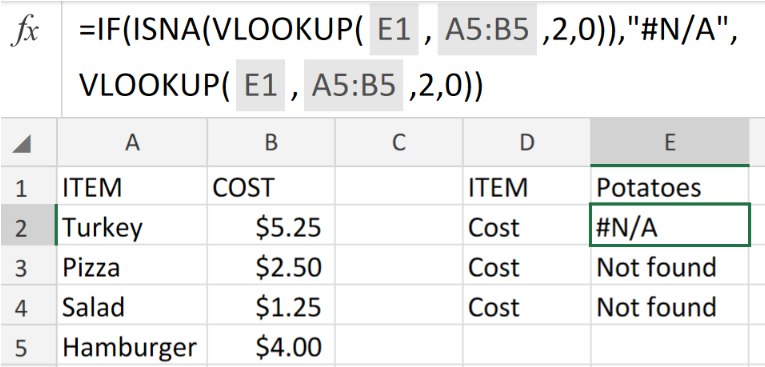

- Modify and copy the formula syntax in cell E2 into the other cells down the column E of our worksheet for the desired error results.

Figure 4. of ISNA Function in Excel.

Figure 4. of ISNA Function in Excel.

Note

- The Excel ISNA Function is categorized under a specific set of Functions commonly known as the “IS FUNCTIONS”. They are mostly utilized for testing results of Excel formulas for Error.

Figure 5. of Final Result.

Figure 5. of Final Result.

Instant Connection to an Expert through our Excelchat Service:

Our live Excelchat Service is here for you. We have Excel Experts available 24/7 to answer any Excel questions you may have. Guaranteed connection within 30 seconds and a customized solution for you within 20 minutes.

Leave a Comment