We can calculate an original loan amount by using the Present Value Function (PV) if we know the interest rate, periodic payment, and the given loan term. This function tells the present value of an investment.The steps below will walk you through the process of calculating an original loan amount.

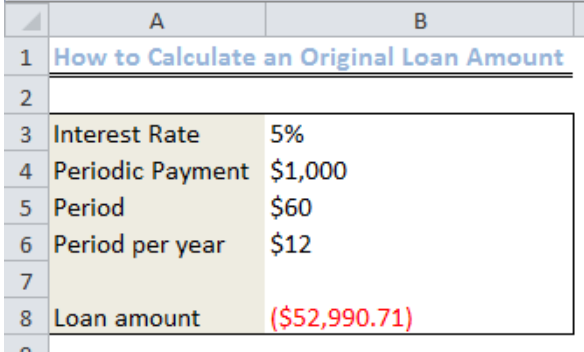

Figure 1: Original Loan Amount

Figure 1: Original Loan Amount

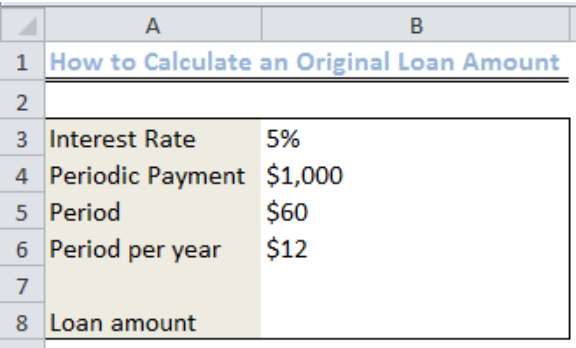

Setting up the Data

We will input the values as shown in figure 2 into Column A and Column B

Figure 2: Data to Calculate an Original Loan Amount

Figure 2: Data to Calculate an Original Loan Amount

Syntax

PV(rate, nper, pmt)

Explanation

- Rate

The rate is calculated as the interest rate per period. If we collectively obtain a loan at a 15% annual interest and make monthly payments, the interest rate per month is 15%/12 or 0.0125. We can input any of the following as the rate:

- 0.0125

- The cell containing the interest rate divided by 12

- 15%/12

- Nper

This is the total number of payments we will make for the loan. Assuming we are to pay the loan monthly in four years, the period is 4*12 (48) periods. We will input this value into the formula.

- Pmt

This is the amount we will pay for each month within the four-year period. This amount covers only the principal which we collected and the interest.

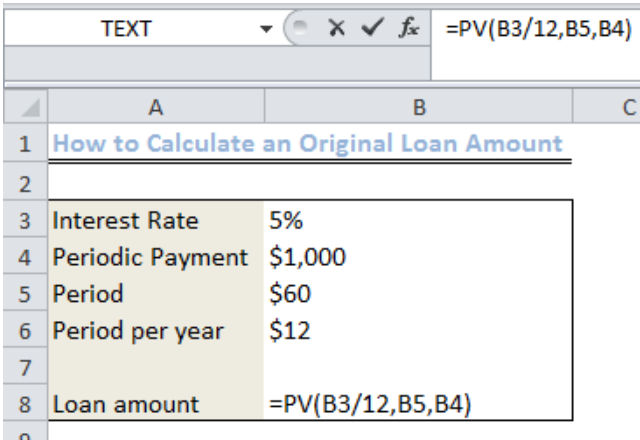

- Formula

=PV(B3/12,B5,B4)

We will type or copy and paste this formula into Cell B8.

Figure 3: Inserting the Formula to Calculate the Original Loan Amount

Figure 3: Inserting the Formula to Calculate the Original Loan Amount

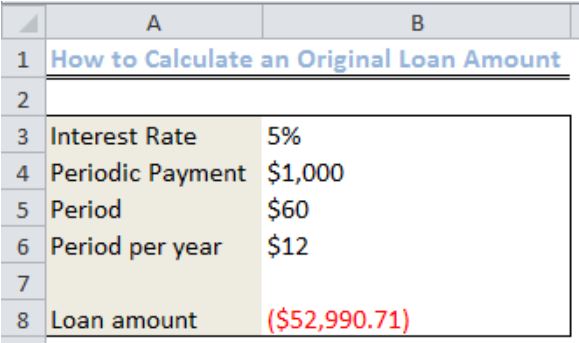

We will now press ENTER

Figure 4: Result of the Original Loan Amount

Figure 4: Result of the Original Loan Amount

Instant Connection to an Expert through our Excelchat Service

Most of the time, the problem you will need to solve will be more complex than a simple application of a formula or function. If you want to save hours of research and frustration, try our live Excelchat service! Our Excel Experts are available 24/7 to answer any Excel question you may have. We guarantee a connection within 30 seconds and a customized solution within 20 minutes.

Leave a Comment